Guidance & Insights

That Support Every Stage of Your Career

OWCP stands for Office of Workers’ Compensation Programs which is a US Department of Labor Program. It administers benefits for federal employees and certain other workers who are injured or become ill due to their job. OWCP full compensation includes covering lost wages that go up to two-thirds of their salary, medical bills, vocational rehab, and scheduled awards. This allows employees to acquire comprehensive financial support during recovery or for permanent conditions.

- The OWCP Full Compensation guidance supports members navigating work-related injury or illness claims. This helps clarify benefits, income replacement options, and coordination with retirement planning so members can not only protect their current income but also their financial stability during recovery periods.

These benefits are designed to ensure financial stability, continued medical care and income protection. When properly managed, OWCP provides critical peace of mind and financial continuity for employees and their families during difficult transitions.

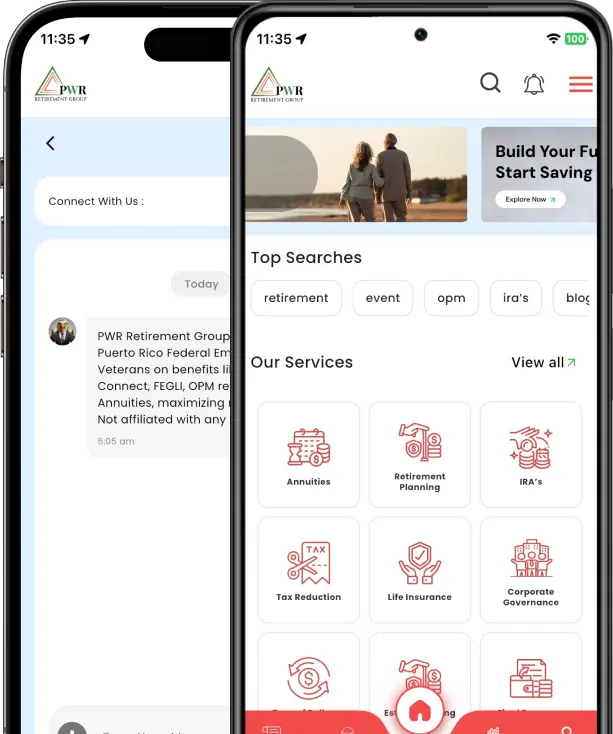

Mike is the AI assistant for PWR Retirement Group, here to help U.S. and Puerto Rico federal employees, veterans, and retirees make sense of their retirement options from the moment they arrive on the site. Whether you’re exploring benefits like TSP, Service Connect, FEGLI, OPM retirement, IRAs, annuities, or advanced income strategies, Mike is designed to point you in the right direction with clear, easy-to-understand guidance—no pressure and no confusion.

He helps you understand what services are available, how different retirement and insurance strategies work, and which topics may be most relevant to your situation. From retirement income planning and federal benefits education to life insurance, power banking, and long-term wealth protection strategies, Mike introduces the tools, calculators, and resources available throughout the site—so you know exactly what to expect before going deeper.

You don’t need to sign up or log in to ask questions, explore topics, or learn how the platform works. When you’re ready to access personalized tools, detailed calculators, or member-only content, you can create an account—but until then, Mike is always available to guide you, explain your options, and help you take the first confident step toward a stronger retirement plan.

FMLA is a popular acronym for the Family and Medical Leave Act. It is a US Federal law that allows eligible employers to take up to 12 weeks of unpaid, job-protected leave in a 12 month period for specific family or medical reasons. If eligible federal employees can apply for this leave without losing their job or health insurance coverage. Employees in crucial situations like childbirth, adoption, or serious personal or family illness can apply for this leave. This benefit allows employees to take time off and promotes work-life balance, specifically for those who need it the most.

What are the key features of FMLA?

Job Protection – While you are on an FMLA leave, your job will be protected, or a comparable position at the same pay, benefits, and responsibilities will be offered.

Healthcare Benefits – Employers must continue to provide their employees with group healthcare benefits while they take leave under the FMLA in the same manner as if the employee were still employed.

Salary Continuation – FMLA leaves are generally unpaid. However, many employers allow employees who qualify for this type of leave to use any paid time they have already earned (i.e., sick or vacation pay) at the same time as they are taking the leave.

Common Qualifying Reasons for FMLA Leave

- Childbirth: Time off for the birth of a child and the first year after that is one of the most popular FMLA leave reasons.

- Adoption or Foster Care Placement: Leave to bond with a newly placed adoption or foster child.

- Care for a Family Member: Caring for a spouse, child, or parent with a serious health condition.

- Employee’s Own Serious Health Condition: This leave applies to any employee suffering from a medical condition that prevents them from performing key job duties.

- Military Caregiver Leave: Up to 26 weeks of leave to care for a covered service member with a serious injury or illness.

Who Is Covered Under FMLA?

Employers

- Private employers with 50 or more employees

- Public agencies, be it local, state, or federal

- Public and private elementary and secondary schools

Employees

- Must have worked for the employer for at least 12 months

- Must have worked 1,250 hours in the previous 12 months

- Must work at a location where the employer has 50 employees within 75 miles

The PWR Virtual Office brings personalized, real-time support directly to you, without the need for appointments, long waits, or navigating multiple departments. It creates a seamless entry point where every client interaction begins with clarity, direction, and efficiency.

When you connect through the Virtual Office, you are first welcomed by a dedicated mediator, similar to a professional receptionist. This mediator listens to your needs, understands the nature of your request, whether it’s retirement planning, benefits guidance, income strategy, or administrative support, and ensures your concern is clearly defined before moving forward.

Once your needs are identified, you are promptly connected to the most relevant associate or specialist within the PWR team. This ensures you speak with the right expert from the start, saving time and delivering focused, meaningful guidance. The Virtual Office is designed to simplify communication, enhance responsiveness, and ensure every conversation moves you closer to confident financial decisions.

The Retention Program is built to mirror the logic of federal government retention incentives—where the goal is not short-term compensation, but long-term continuity, expertise preservation, and relationship control. Rather than ending engagement at separation, this program allows employers to maintain structured, compliant connections with high-value employees even after they leave active service.

In the federal system, retention programs are used to prevent the loss of critical talent by tying incentives to service agreements, specialized roles, and institutional knowledge protection. This program applies that same principle to employer-sponsored financial benefits. When an employee participates in annuities, executive bonus plans, or long-term retirement structures funded or facilitated by the employer, the relationship does not terminate when employment ends—it transitions into a governed continuation phase.

Through formalized service-style agreements and benefit-based touchpoints, former employees remain connected via the financial vehicles they already hold. Ongoing communication, annual reviews, compliance-aligned outreach, and advisory access ensure the employer remains a central point of continuity, not a former checkpoint. This reflects how federal agencies retain influence and engagement with specialized employees even amid role changes or agency transfers.

How the Retention Program Functions in Practice

Once an employee exits, the program activates a post-employment engagement framework. Rather than a passive benefit handoff, the employee enters a structured lifecycle that includes scheduled reviews, benefit performance monitoring, education updates, and long-term planning support tied directly to the original employer-sponsored strategy.

TSP Guidance focuses on optimizing fund selection, contribution strategy, and risk exposure within the Thrift Savings Plan’s unique structure. Unlike private-sector 401(k)s, the TSP limits participants to specific core funds (G, F, C, S, I) and Lifecycle (L) Funds, each with defined benchmarks and risk profiles. Effective guidance involves aligning fund allocation with time horizon, volatility tolerance, and federal employment status, while understanding nuances such as the G Fund’s government-backed principal protection and the equity concentration risks within C and S Funds.

Contribution and tax strategy are central components of proper TSP guidance. Decisions between Traditional and Roth TSP contributions materially affect lifetime tax outcomes, especially when coordinated with federal pensions, Social Security timing, and required minimum distribution (RMD) rules. For 2025, employees can contribute up to the IRS annual limit, with additional catch-up contributions for those age 50+, but guidance ensures contributions are structured to maximize agency matching while avoiding overexposure to future tax brackets or IRMAA-related Medicare surcharges.

Withdrawal planning is where technical guidance becomes critical, and mistakes are costly. TSP distributions are governed by strict rules around partial withdrawals, installment payments, rollover timing, and taxation of mixed Traditional and Roth balances. Poor sequencing can accelerate tax liability or force premature depletion of tax-advantaged assets. Proper TSP guidance integrates rollover analysis, income layering, and distribution timing to maintain flexibility, control taxable income, and preserve long-term retirement sustainability.

Member recruitment in the federal government follows a merit-based, structured process designed to ensure qualified hiring across agencies. Vacancies are identified based on operational needs and filled through competitive or non-competitive methods in accordance with OPM regulations. Candidates are evaluated on education, experience, and role-specific competencies to maintain fairness, transparency, and workforce quality.

Multiple hiring pathways are used to meet mission and skill demands. These include direct recruitment open to the public, internal transfers or deputations, contractual hiring for specialized needs, and re-employment of previously separated or retired personnel. Each pathway is governed by defined eligibility and screening standards to balance flexibility with compliance.

The process moves from recruitment to formal appointment through defined stages. Agencies advertise positions, screen applications, conduct assessments, and select candidates before issuing an official appointment. Recruitment incentives may be applied in hard-to-fill or mission-critical roles to support workforce continuity without compromising merit-based principles.

Members University is an exclusive, members-only education platform created to give union members direct access to clear, practical financial guidance. Each month, members are invited to a 45-minute live Master Class held via Zoom, designed as an interactive session rather than a lecture. These sessions focus on real financial topics that matter at different career stages—ranging from everyday money decisions to long-term retirement and income planning—allowing members to ask questions, share perspectives, and gain clarity in a supportive, union-guided environment.

The structure of Members University is intentionally designed to encourage open discussion and strategic thinking. Instead of one-way presentations, the sessions foster conversation around financial literacy, benefit optimization, and retirement readiness, helping members understand how today’s decisions affect their future security. Whether a member is early in their career or approaching retirement, each class is built to translate complex financial concepts into understandable, actionable knowledge without pressure or sales influence.

By participating consistently, members build confidence, foresight, and a stronger sense of financial control over time. Members University supports long-term success by keeping education ongoing, relevant, and paced to individual needs. It reinforces the union’s commitment to member well-being by providing trusted guidance, shared learning, and a community-focused space where planning for the future becomes clearer, more strategic, and less overwhelming—today and for the years ahead.

Union University

An Exclusive Member Education Platform

Union University provides structured education designed to help union members build financial confidence and retirement awareness at every career stage.

Designed For Every Stage of Your Career

Members Near Retirement

Critical knowledge for those approaching their next chapter

Early-Career Members

Start building your foundation for long-term success today

Recognized by Industry Leaders

PWR Retirement Group is recognized by respected industry organizations for our commitment to education-first guidance and excellence in retirement planning for union members and federal employees.

10,000+

Members Supported

100%

Secure & Confidential

15+ Years

Industry Experience

4.9 / 5

Member Rating